Some say that knowledge is power. We at Primary Intelligence believe that the right kind of knowledge is exponentially powerful.

An example of our intelligence and feedback we provide is listed below. In this example, our client is Tenscon, a software solutions provider. Now, we have changed the names to maintain confidentiality, but our customer list includes companies such as Microsoft, Avaya, Symantec and EDS are the kinds that tend to do very good work with us.

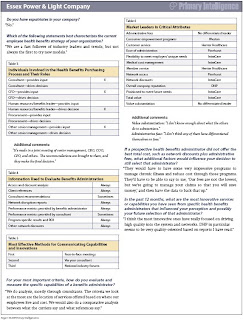

The table below shows "Tenscon's" competitive advantage against 4 competitors (Names have been changed to maintain confidentiality, but the results are real).

The results show some competitive advantages in the company and sales, but the product has some significant weaknesses against Sistemic and Howein Partners:

Overall, Tenscon had generally higher performance ratings than the competition, especially in the company and service drivers. However, several ratings for the sales team were lower than those of the competition as a whole, indicating that some improvement in these areas may be needed.

An analysis of the responses from clients yields the following key findings concerning Tenscon’s performance:

-Tenscon was seen as a strong and solid company, but was not generally seen as an innovator. As a senior vice president from Dillent explained, “I don’t think they showed as much innovation in their solution. I think they took a much more conservative approach, a much more introverted approach rather than an innovative approach.” The CIO from ABC Aerolineas echoed this sentiment by saying, “We have some applications that we expected to be technologically advanced, but what they offered us was delayed during the delivery process. By this I mean that some applications were not as innovative as we expected them to be.”

-Some clients were concerned that Tenscon was not offering a unified solution, but rather a set of pre-packaged offerings. For instance, a respondent from ABC Aerolineas said that the initial Tenscon team did “have a real understanding of our model, and they just trying to sell us stand-alone systems. This was the idea. The idea was a cost-effective strategy, and people from Tenscon did not understand our model, our strategy, the market, or our needs. They just about systems and stand-alone processes.” A representative from Flentic Crendall explained, “One of

complexities of [Tenscon] is it is five separate businesses that have been swept into one company. It’s trying get them to work as one company with one approach. don’t think that there was a perfect solution.”

-While a majority (66 percent) of clients believed that Tenscon put the right people in front of them, there were some concerns that decision makers were not involved in the negotiation process. A vice president at JNPD expressed this sentiment, saying, “As some of these things escalate, or we run across impasses, there might be opportunities in the future that if we were

able to talk directly to the true decision makers, then it might expedite the process.” A senior vice president from Fiserv also said, “It took a while to get the right representatives from the healthcare side and from the financial side [of Tenscon] to be on our team.”

-Understanding the clients’ needs and business requirements was a theme throughout the interviews, and an area where respondents believed Tenscon could improve. Tenscon’s ratings in this area were slightly lower than the average for other bidding companies, indicating an area of advantage for Tenscon’s competitors. As the CIO of Coles Meyer explained, “Sometimes I was worried [that they gave] affirmative answers without really understanding what the issues were. At

times I felt they didn’t understand how big and complicated the work was going to be. ‘Let’s make the sale and then afterwards worry about how we are going to deliver it.’ There was a lack of business and delivery knowledge with the up front sales team. With other vendors we don’t experience that.”

If you have any ideas of how to make these data come to life in your organization, drop me a line. (801.838.9600 x5050, cdalley@primary-intel.com)

.jpg)